Forex Today: US Dollar struggles to extend recovery on last trading day of week

Contents

Currency swaps – Where two parties can ‘swap’ currency, often in the form of loans, or loan payments in differing currencies. Futures forex contracts – Delivery and settlement takes place on a future date. Prices are agreed directly, but the actual exchange is in the future. Trading forex on the move will be crucial to some people, less so for others. Most brands offer a mobile app, normally compatible across iOS, Android and Windows. Kane is a British researcher and highly skilled writer with a special interest in finance, financial crime, and blockchain technology.

Those with ‘2022 forex trading guide’ in the title will have up-to-date, relevant information. Experienced traders such as Coleman D’Angelo have several recent videos with strategy explanations and software advice. Books –You can get profitable strategies books, books on scalping, regulations, price action, technical https://1investing.in/ indicators, and more. Though there is no universal top forex book, Jim Brown is a notable author with many bestselling books. Utilise forex daily charts and graphs to see major market hours in your own timezone. The below image highlights opening hours of markets for London, New York, Sydney and Tokyo.

- Before entering into the buying and selling ring, you must have labored out the quantity of price range you may allocate as your operating capital.

- When the trader has identified a trading opportunity, it will instantly send a signal to its member base.

- You have time to analyze the markets at the beginning of the day and can monitor them throughout the day.

- Hence, traders need to be fast with their investments and market exit to limit the loss.

- To reiterate, an ASIC forex broker can offer higher leverage to a trader in Europe.

- A demo account is a safe space to take your time and get to know all of the complex aspects of currency trading at your own speed.

In fact, this will ensure that you keep your trading stakes sensible and thus – avoid burning through your brokerage account balance. Then, once you are confident that your strategies have the potential to make you consistent profits, you can then switch over to a real money account. Even if you are an experienced forex trader, demo accounts are superb for backtesting new systems. Day trading in the forex industry refers to a specific short-term strategy that focuses on small but frequent gains.

Trading Journal

For example, this includes the types of pairs you are trading, how much you are staking, what percentage gains you make, and how much leverage you apply. This is because some trader might remain open for several hours while others for just a few minutes. Then, at the end of each week, you can review your forex trading journal and assess whether or not you could have done things differently. If you then find that a particular system or a forex trading strategy is working well for you, it will be much easier to identify this. EToro is also a great option if you are planning to diversify into other asset classes.

Countertrend trading favors those who know recent price action really well and so know when to bet against it. Since our thinking is a “counter trend”, we would look for trades in the opposite direction of the overall trend on a smaller timeframe such as a 15-minute chart. Once the overall trend is established, you move to a smaller time frame chart and look for trading opportunities in the direction of that trend.

Bear in mind forex companies want you to trade, so will encourage trading frequently. Level 2 data is one such tool, where preference might be given to a brand delivering it. The differences can be reflected in costs, reduced spreads, access to Level II data, settlement or different leverage.

In the strategy, traders invest in the short-term markets and take benefit of the change in the price patterns. In forex trading, investors trade with currency pairs as one is bought and the other is sold simultaneously. Thus, the market maintains its liquidity and gives investors several opportunities to trade. The currency pairs have two types of currencies, the base, and the quote currency. Investors should be aware of these terminologies for investing properly and having high profits. The forex market provides day traders with several advantages over trading shares on the stock market.

Trading through books is beneficial for sure, but in the long run, taking extraordinary steps is viable, if you want to see more and more gains over time. Hence, day traders use the RSI indicator for the high-income trading framework. Traders can also define the best entry/exit point with these indicators while also consolidating the markets. The reversal scalping strategy involves identifying and capitalizing on reversal or retracements in short-term price trends. Because predicting troughs and peaks accurately are quite difficult, traders try to find short-term pullbacks and trade them to make small, quick profits. The risk in executing such trades is limited as they aim to profit from minor pullbacks.

– Range-Trading Scalping Strategy

Please list all of the “cherry picked” examples and we can remove anything that does not follow the strategy. There are thousands of strategies, it is your job to follow the rules and see if it works for you. Enter the BUY trade trade when candle closes above both 9 and 20 EMA after the trend line break. The goal with this strategy now will be to find a break of this trend to the upside. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace.

Usually, day traders use M5 or M15 charts to develop their strategies. However, RSI is a fast indicator and you need to make a combination of a few charts. For example, you can monitor your asset on M15, M30, and Daily charts and make a better decision when you look broader picture – overall trend and micro trend . Day traders execute short and long trades to capitalize on intraday market price action, which result from temporary supply and demand inefficiencies. When it comes to averaging down, traders must not add to positions but rather sell losers quickly with a pre-planned exit strategy.

Traders invest in the currency pairs using the scalping strategy, where they hold the market position for not more than an hour. Day trading forex can be a profitable activity if you learn the ins and outs of forex trading. Thankfully, you can start day trading forex with very little capital, and you don’t have to face pattern day trading restrictions applied to stock day traders.

When did forex trading start?

Using indicators on the shorter time frame chart will give you an idea of when to time your entries. For an example of this style of trading, see Pip Surfer’s world-renowned Cowabunga System. Trend trading is when you look at a longer time frame chart and determine an overall trend. Monitoring short-term price action is used to identify optimal entry and exit positions.

Break above that would obviously be very bullish, just as breaking below the hammer from the Thursday session would be. It is no secret that global financial-market volatility has skyrocketed in 2022. Market participants are wondering how things will end with increasing inflation, stock prices plummeting, geopolitical tensions in Eastern…

With the article, we have provided readers with the details of the forex market, day trading, and how the day trading works if used in the forex market. They can use the forex day trading strategies such as mean reversion, scalping, swing trading, money flows, and trend trading to enjoy high profits from short-term trades. Forex day trading involves buying and selling currency pairs with the view of making short – but frequent profits.

It can be an emotional rollercoaster— You’ll experience many highs and lows as you strive to achieve success in Forex day trading. You have to get in the habit of managing your emotions well in order to avoid making bad decisions. Useful skill—Since Forex day trading is a part of your daily routine, it will give you a boost to be more focused, psychologically stable, and capable of making better decisions. The thrill of the chase— Sadly, most people do not enjoy their jobs. As you improve at Forex day trading, your life will become more exciting and can be a worthwhile adventure. Day buying and selling may be demanding and the pressure can crop up all day long as you search for the proper second a favored inventory may be picked up at its lowest.

What units is forex traded in?

Cory is an expert on stock, forex and futures price action trading strategies. A day trader who is using this strategy and is looking to go short will sell around the high price and buy at the low price. To make a career out of forex trading, clients need a consistently successful strategy. Traders will also need to define their risk tolerance and have enough capital to cover potential losses. A forex broker is a firm that provides access to a platform on which foreign currencies can be bought and sold. Brokers may use different platforms or offer different pairs of currencies to be traded, though they all offer the same base service.

So a long position will move the stop up in a rising market, but it will stay where it is if prices are falling. It allows traders to reduce potential losses in good times, and ‘lock in’ profits, whilst retaining a safety net. The best online brokers allow you to trade assets with leverage – meaning you can increase the value of your stake.

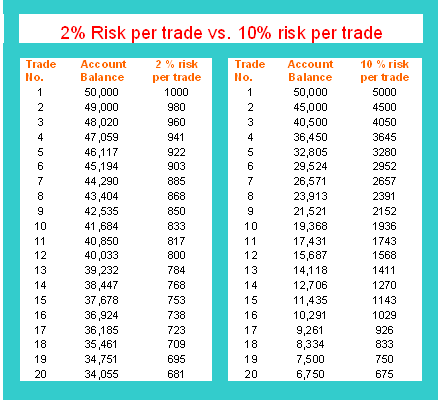

A common rule is that a trader should risk no more than 1% of capital on any single trade. Traders know the news events that will move the market, yet the direction is not known in advance. Therefore, a trader may even be fairly confident that a news announcement, for instance that the Federal Reserve will or will not raise interest rates, will impact markets. Even then, traders cannot predict how the market will react to this expected news. Other factors such as additional statements, figures, or forward looking indicators provided by news announcements can also make market movements extremely illogical.

However, some traders have raised concerns over the complexity of reading its infrequent trading signals. It is so because many intraday traders utilize this indicator to get profits through the high risk-reward ratio. Hedging in forex is a risk management strategy that is used to protect the gains or limit the losses on an open forex position. Traders use hedging techniques to protect their positions from abrupt market moves. To hedge a position, a trader can either open an inverse or opposite position to their existing position in the same currency pair.

Forex Day trading involves buying and selling currency pairs that one believes will rise during their chosen timeframe. In any case, be careful not to overextend yourself; losing money can result in more than just financial ruin. The forex market is extremely liquid with an enormous number of buyers and sellers available at any point in time.

Still, forex traders need to follow the general rules related to forex trading, such as initial margin requirements, maintenance margin, and margin calls. Many brokers allow you to trade with a 1% margin, which means that you can Types of Assets open trades worth 100 times more than the amount you have in your trading account. Your forex trading profits depend on a lot of factors, including your trading strategies, risk management techniques, and your initial capital.

You can be your own boss—If you dislike working for someone else and want to be your own boss, Forex day trading is an option for you. It is even greater applicable for an excessive-strain task that calls for you to interpret technical charts, comply with marketplace tendencies and take selections all day long. Trading itself needs intensive know-how of the ideas and the dependencies that affect them.