10 Trendy Ways To Improve On best gold ira companies

Best Gold IRA Investment Companies for 2023

Gold IRA custodians are knowledgeable about the rules and regulations that govern investments in gold, so they can help investors make the best decisions for their retirement savings. SPDR Gold Shares® GLD® the world’s largest and most liquid gold backed ETF offers strategic, long term investors access to the gold market. Gold, silver, palladium, and platinum. In the second place, we have American Precious Metals, which has a history of over a decade and it’s notorious for helping clients diversify their portfolios. The big difference between Augusta Precious Metals and Goldco comes down to the required initial investment. But the stock market is volatile, and if it crashes, you could lose everything. These investment schemes may involve a purported exchange offer with a company called “United Commodity AG” or with other small companies, offers to broker sales of gold bullion, doré or coins to investors, offers to sell “memberships” in Barrick or its affiliates, or offers including from a company called “Golden Compass” to sell cryptocurrencies or digital coins supposedly backed by or associated with Barrick. Hence, the company may not be able to guarantee your precious metal’s value at any particular time. This family owned company managed to do that by implementing a fairly honest and transparent fee system for their clients to view and pursue, making them one of the best gold IRA companies overall. Metals must also meet other qualifications pertaining to their condition near perfect, weight, and authenticity.

Gold represents the spirit of wealth, prosperity, and security Everyone has heard of it, but did you know there are dozens of ways to utilize gold for your portfolio?

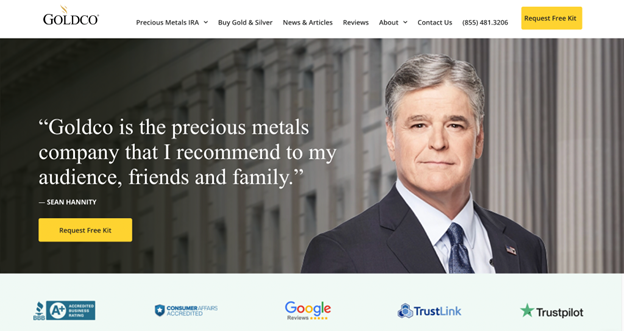

Secure Your Wealth with American Hartford Gold Group Invest in Gold Today. The only distinction between a gold IRA and a conventional IRA is that physical precious metals constitute the invested assets in a gold IRA. GoldCo’s gold IRA custodians are also committed to providing customers with the highest level of customer service. Discover the Benefits of Investing with Birch Gold Today. Dedicated customer service. Birch Gold Group Runner up. While most IRAs invest in paper assets such as stocks and bonds, a precious metals IRA gives you the ability to add hard assets to your retirement savings. The Patriot Gold Group offers gold and precious metals IRAs. With Gold Alliance, you can rest assured that your investments will be secure and your retirement savings will be well taken care of. But you’ll have to pay income taxes if you rollover to a Roth IRA. May not be suitable for investors with smaller account balances.

Here are our picks for the top gold IRA companies in five categories:

Because of IRS rules, you cannot store your physical gold at home. In addition, investing in gold and other precious metals can help you hedge against inflation. Oxford Gold Group IRA Accounts. Please consult with a professional gold in an ira who may specialize in these areas regarding the applicability of this information to your individual situation. By placing precious metals in an IRA, you can thus potentially preserve your buying power and help safeguard your money from the effects of inflation. Secure payment options. Their online platform provides clients with a secure, reliable, and trustworthy service, making them a great choice for those looking to invest in gold. So, when choosing a gold IRA company, things to look out for are as follows. With the help of one of the best gold IRA companies, you can ensure the process is completed correctly and efficiently. So if you’re looking for a safe and profitable way to invest in gold, a Gold IRA is the way to go. State and local governments issue municipal bonds and can provide tax free income for retirees. Gold assets owned and operated by Barrick — the most in the world — plus a strategic copper portfolio.

4 Lear Capital: Best For Gold IRA

Their team of knowledgeable professionals are highly experienced in the precious metals industry, providing customers with the best advice and guidance to help them make informed decisions. When it was time to select various quantities of metals, they spent time with me on the phone to provide recommendations and options based on my particular goals. Anxiety about risks are alleviated with a 24 hour risk free purchase guarantee as well as consultations from experienced specialists in developing strategies to buy or sell metals. Security: Gold is a secure investment that can protect your retirement savings from market volatility. Prices quoted for gold run high compared to the market. The company offers competitive rates and reliable customer service, making them a trusted gold IRA custodian. The lowest investment minimum otherwise is Noble Gold, which requires $5,000 if you’re doing a rollover.

Types of Gold IRAs

We also have a team of experts that can provide you with the facts needed to make an informed decision with the ownership of your precious metals. American Hartford Gold. This conference provides valuable insights into the world of precious metals investing. With the American Hartford Gold Group, customers can rest assured that their investments are secure and their retirement savings are protected. It is important to check with the gold IRA company to determine which types of gold are eligible for purchase and storage in the account. Therefore, when you consult with gold IRA companies, you’ll notice that they’re not the most popular option. Here we have listed some of the popular Gold IRA businesses. Gold IRA Zone is a leading resource for information about gold IRA investments. The company even offers rare, numismatic coins as part of its portfolio, as well as traditional physical gold and silver coins and bullion.

7 Advantage Gold: Best For Beginners

Call 1 844 754 1349 to discuss your self directed precious metal backed IRA options. Even if you did have large sums of cash ready to buy gold with from a dealer, that’s after tax money; your net capital that’s left after the tax man gets his cut of your gross income. This process is simple and straightforward. 6 stars based on 1,000+ reviews and Birdeye 4. This is one of the lowest requirements in the industry. The Birch Gold Group promptly became a trusted name in the gold investment industry. If you’d rather invest in gold that you can store yourself, you can buy physical gold through one of the companies on our list. Fortunately, there are other highly rated companies on our list that would be happy to facilitate your gold IRA for as little as $10,000.

Noble Gold Best for Coin Selection

Top organizations typically have a three part process for unlocking your self directed IRA, which will walk you through each stage. Discover the Benefits of American Hartford Gold and Start Protecting Your Future Today. The Noble Gold website claims that the company’s access to a wide variety of suppliers allows it to offer the most competitive pricing and the best deals in the industry. ✅ Wholesale Gold IRA Pricing. A: Yes, in addition to physical gold and silver, you can also hold other precious metals such as platinum and palladium in a gold and silver IRA. Moreover, Regal Assets has a very good reputation for having only been in business a decade. These options allow clients to diversify their portfolios and protect their wealth against economic uncertainties. The company’s commitment to transparency and customer service is also exemplary, making it one of the best gold IRA companies. And if you ever want to sell back your gold, they have a buyback program that guarantees the best prices in the market. If an investor fails to complete the transaction within that period, then the transaction will not count as a rollover but rather as an IRA withdrawal. The companies also provide helpful gold backed IRA information to help customers understand the process and make informed decisions.

Gold Alliance: Cons Gold and Silver IRA

The Better Business Bureau is an organization that allows consumers to write reviews and, often, complaints of businesses online. With years of experience, GoldCo’s gold IRA custodians can help customers make the most of their gold IRA investments. The company also has international depository services available. They meet the following requirements. In addition, investors may feel more comfortable knowing that they own a physical asset stored by a custodian. As such, you don’t need to worry about the wealth being seized by the US government or by your own government. They’ll deal directly with you and ensure that such conditions are met. If you are looking to roll over on your Roth IRA, SEP IRA, Simple IRA, or eligible 401k, 403b, and more, Birch offers the services to get your funds efficiently and legally transitioned.

What Is The Minimum Investment For A Gold IRA Account?

Despite primarily being a gold IRA company, Goldco also sells precious metals directly to customers and they will either ship it to your address or store it on your behalf. The advantage of this program is that it allows you to sell your silver, gold, platinum, or palladium coins at a higher price than you would from a random coin dealer. Goldco is a California based, privately held business. Unlock the Potential of Your Portfolio with Oxford Gold Group. If you’re ready to diversify your portfolio and invest in precious metals, our list of the best gold IRA companies is a great place to start your journey. Comprehensive FAQ and help center. Only those metals approved by the IRS for inclusion in a precious metals IRA are acceptable. Other Advantage Gold highlights include. For example, you could have one IRA that is invested in precious metal bullion, and another IRA that’s invested in liquid assets, such as publicly traded stocks and mutual funds. Augusta Precious Metals. Furthermore, if you need to sell your gold, it is usually simple, which means you will not lose access to your money. A gold IRA is an Individual Retirement Account that allows you to invest in gold, and other precious metals. If you found our content helpful, consider leaving a review on Google or Facebook. Along with the more complex nature of managing your gold IRA comes higher fees than traditional IRA products.

Featured Video

When you choose a reputable custodian and reputable storage, you can rest assured of the safety of your IRA precious metals. Robert of Lake Geneva, WI rated 5 stars on Consumer Affairs. Founded in: 2012Headquarters: Beverly Hills, CaliforniaType: PrivateEmployee Size: 10 – 50. Thankfully, the companies on our list act as brokers by facilitating all the steps involved in purchasing precious metal IRAs. Goldco primarily offers two major services as outlined below. => Visit Oxford Gold Group Website. SDIRAs are similar to a Roth or traditional IRA in that they limit how much you can invest each year.

Reviews

IRA Copper Account: 2. Apart from the Augusta team and your personally assigned agent walking you through the account opening process, they also do most of the paperwork with you. You can also download the Lear Capital Spot Price app on the Apple or Google Play app store to access these resources on a mobile device. ITrustCapital stands out as the ultimate choice for investors seeking to expand their portfolio beyond traditional assets. That’s where the Royal Survival Packs come in. Although there are aspects that we don’t like about the company, they are really for better convenience. It also uses Brinks Global Services yes, the Brinks of armored truck fame. In addition to the cost of the metals themselves, you’ll need to budget for other fees related to establishing and maintaining a gold IRA. Gold, silver, platinum, palladium, and other metals are beneficial options for saving your savings from various economic risks. Generally, clients report that they felt appreciated by the Augusta staff, who didn’t pressure them to make any purchases. A gold IRA safeguards your savings from the highly volatile stock market and also hedges against creeping inflation. Additionally, they pride themselves on transparency when it comes to pricing and fees so that customers know exactly what they’re getting into before signing up. Among the top gold IRA custodians are Augusta Precious Metals, American Hartford Gold Group, Oxford Gold Group, and Lear Capital. Goldco has received an A+ rating from the Better Business Bureau and a Triple A rating from Business Consumer Alliance.

PROS

Their commitment to customer service and satisfaction is unparalleled, and they are always willing to go the extra mile to ensure that their customers are getting the best possible experience. The custodian will store the metals in a secure vault and provide you with a statement of your assets. Investors can choose to invest in gold with many investment products. These rankings are often based on several factors, including reputation, legitimacy, and customer service. Noble Gold is our top recommendation for small investors looking to venture into precious metals IRAs because they have minimum investment requirements and extensive educational resources for customers. In addition to helping their customers invest in precious metals, they will also be there for you when it comes time to cash in. Experience Unparalleled Financial Security with Patriot Gold Club. You may also be charged various fees if you don’t transfer funds from an existing retirement plan to a new one. Their website contains all the required information, such as fees, charges, and transaction related expenses. Augusta Precious Metals makes sure your metals are safely shipped to their destination once purchased.

Protect and Secure Your Retirement Savings Now!

The company has served customers for over two decades and has completed over $3 billion in precious metals transactions. A gold IRA is typically held by a custodian, such as a bank or financial institution. The truth is that they might have strong values, but there have been times in history when their values drop below profitable level. With so many precious metals IRA companies offering these accounts, choosing one with a solid track record, financial stability and reputation will help ensure your investment performs as expected. They will handle all the necessary paperwork and work with the brokerage firm to manage your assets, ensuring that your investment complies with all IRS regulations. Another thing that distinguishes Goldco from other gold IRA companies is its exceptional buyback program. The physical gold is fully owned by you. A “Gold IRA,” is a self directed retirement account that primarily consists of gold or other precious metals. The company enjoys an A+ rating with the BBB and a perfect 5. While Gold IRAs offer numerous advantages, it’s essential to recognize their potential downsides. There is no guarantee that they will be able to mine the gold, so the share price can fluctuate quickly. The IRS details regulations regarding the storage of any physical gold, silver, platinum, or palladium that backs an IRA.

Take Us With You

For instance, if an investment struggles due to poor economic conditions, it may become much harder to trade and even result in a loss. Once you’ve created your account, you’ll need to fund it with money from your existing retirement account. Since they exist outside of any centralized currency or government, they skyrocket in value when the value of centralized assets dips. Precious Metals Storage. Some of the best IRA gold companies will waive this fee for larger initial investments. If you’re looking for a gold IRA company with impeccable reviews and ratings, look no further than American Hartford Gold. If you want the account to contain some rare coins and bars, then you can do so.

Average star ratings

These precious metal coins offer alternative investment options — silver coins are typically more volatile than platinum or palladium but have a much lower cost of entry, while gold coins are less volatile in the short term but typically provide long term growth. The company provides extensive advice on how to complete the application for a new self directed IRA and will assist you in the rollover of funds from your existing retirement account to your new gold IRA. These vehicles safeguard money to fund your retirement. 0 stars on TrustLink. Additionally, maintaining an IRA can cost up to $300 per year, not including fees incurred when purchasing and shipping precious metals. Noble Gold does not charge a commission on any trades. Although you can sign up online, there’s limited detail about the available assets and pricing.

ReadLocal

When it comes to finding the best gold IRA companies, you need to read the fine print. This company is regarded as a market leader when it comes to precious metals IRAs. 9/5 Stars From 148 Reviews. 95%, and the purity of silver, platinum, and palladium must be near perfect at 99. Income generated from these assets may be subject to tax deferments or exemptions, making them an attractive long term investment option. We rated each gold ira provider below on a variety of factors including reputation, annual fees, selection of precious metals, buy back program, and user reviews. If you just invest in one type of asset class, such as stocks or bonds, you may find yourself vulnerable to fluctuations in the market. These metals hold significant value due to their rarity, usefulness in multiple industries, and ability to store value. American Hartford Gold is a family owned company that made the Inc. Start Investing in RC Bullion to Secure Your Financial Future Today. You may also want to investigate where your gold investments will be physically held.